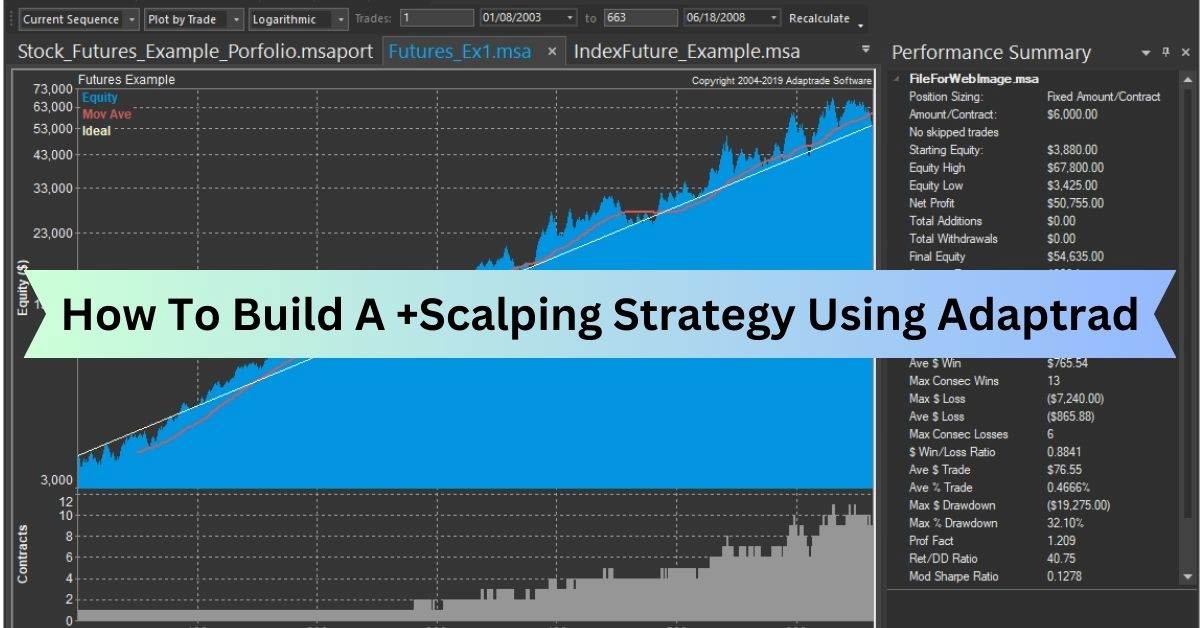

How To Build A +Scalping Strategy Using Adaptrad – Know Here In Detail!

Come into the world of Adaptrade and unlock the secrets to building a successful scalping strategy. With just a few clicks, you will be on your way to maximising profits and seizing opportunities in the fast-paced trading world.

Building a scalping strategy with Adaptrade involves selecting suitable indicators, optimising parameters, and setting clear entry and exit rules for quick trades in the market.

To get the amazing information on this, you must stay with me until the article’s end. So, come ahead and get the full scoop.

Understand The Scalping Strategy Basics – Explained For Ease!

Scalping is a trading strategy that involves making quick, short-term trades to capitalise on small price movements in the market. It’s like surfing the waves of the market, aiming to catch small profits multiple times throughout the day.

To grasp the basics of scalping, it is essential to understand its core principles and why traders opt for this approach. At its core, scalping relies on exploiting small price differentials in the market.

Traders aim to enter swiftly and exit positions, often holding trades for a few minutes or seconds. This rapid-fire approach requires traders to have a keen eye for market movements and the ability to make quick decisions in response to changing conditions.

However, scalping also comes with its challenges and risks. The fast-paced nature of scalping requires traders to have a solid understanding of market dynamics and a high level of discipline to stick to their trading plan.

Additionally, transaction costs such as spreads and commissions can eat into profits, making it crucial for scalpers to manage their expenses carefully.

Why Use A Scalping Strategy? – Here To Know!

Firstly, scalping allows traders to capitalise on small price movements in the market, enabling them to generate profits quickly and efficiently. By making multiple trades throughout the day, scalpers can accumulate gains even from minor fluctuations in price.

Moreover, the scalping strategy is well-suited for traders who prefer an active and dynamic trading style. Unlike longer-term trading strategies that require patience and endurance, scalping offers the excitement of rapid-fire trading, keeping traders engaged and focused throughout the trading session.

Additionally, a scalping strategy can be particularly advantageous in markets with high liquidity and volatility. Price movements frequently occur in such markets and are often more pronounced, providing ample opportunities for scalpers to enter and exit trades at favourable prices.

Overall, the use of a scalping strategy can be an effective approach for traders looking to capitalise on short-term opportunities in the market.

Whether it’s generating quick profits, enjoying an active trading style, or taking advantage of market liquidity, scalping offers a range of benefits that appeal to traders with varying preferences and objectives.

Key Principles Of Scalping – Must Explore!

The scalping strategy is grounded in several key principles that govern its execution and effectiveness in the market. Firstly, timing is critical in scalping, as traders aim to enter and exit trades quickly to capitalise on short-term price movements.

Moreover, scalping relies on the principle of leveraging small price differentials to generate profits. Traders aim to capture small gains from each trade, with the cumulative effect of these gains contributing to overall profitability.

Another key principle of scalping is risk management. While scalping can offer the potential for quick profits, it also comes with inherent risks, including transaction costs and market volatility.

Effective risk management involves setting strict stop-loss orders, managing position sizes, and adhering to a disciplined trading plan to mitigate potential losses.

Furthermore, discipline and consistency are essential principles of scalping strategy. Traders must adhere to their trading plan and avoid emotional decision-making, even in the face of market fluctuations or unexpected events.

Ultimately, Consistent execution of the scalping strategy over time is crucial for achieving long-term success and profitability in the market.

Strategies To Adopt For Making The A +Scalping Strategy

1. First of all, You Need to define the Strategy Objectives:

Before getting into scalping, it’s crucial to define your objectives clearly. Determine your profit targets, risk tolerance, and timeframe for trades.

Whether you aim for quick profits or steady gains, having well-defined objectives will guide your trading decisions and keep you focused on your goals.

2. Then, You Must Optimize the Indicator Parameters:

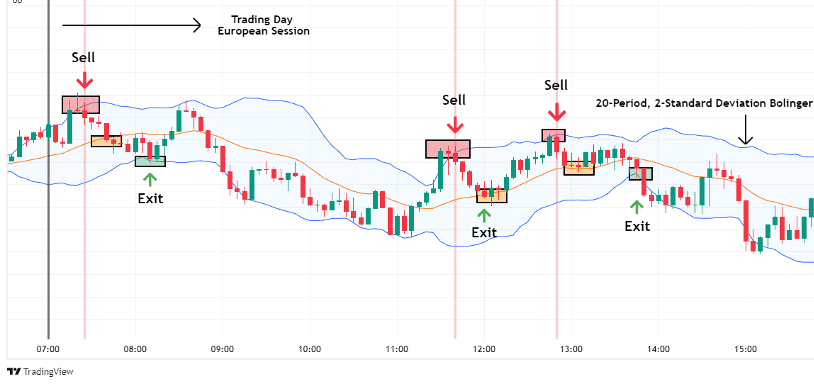

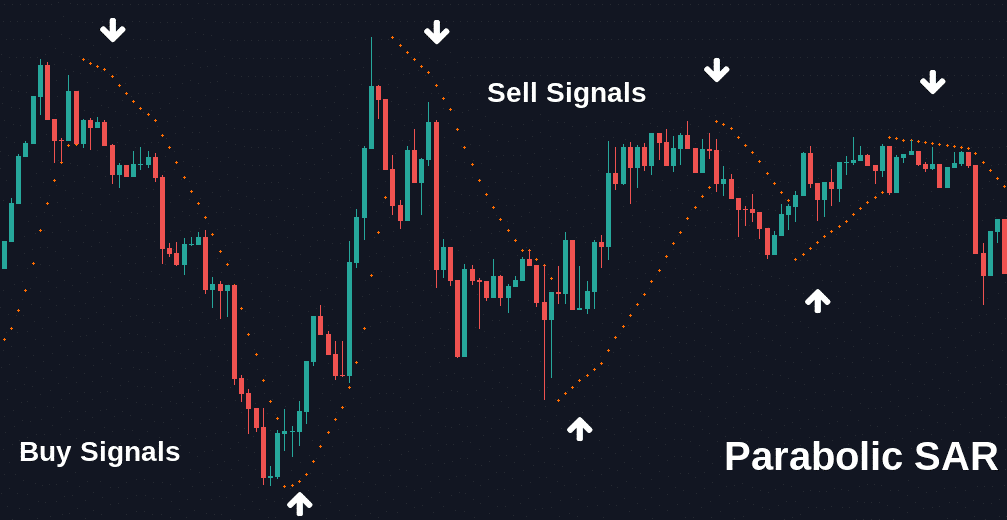

Selecting the right indicators and optimizing their parameters is essential for a successful scalping strategy. Experiment with different combinations of indicators and parameters using optimization tools like Adaptrade to find the best settings for your trading style.

3. Must Set the Entry And Exit Rules:

Establishing clear entry and exit rules is crucial for executing successful scalping trades. Define criteria for entering trades based on your selected indicators and optimized parameters.

Determine when to enter a trade, where to set your stop-loss and take-profit levels, and when to exit a trade to lock in profits or cut losses.

4. Keep Implementing Risk Management Techniques:

Effective risk management is essential to protect your capital while scalping. Set strict stop-loss orders to limit potential losses on each trade and use position-sizing techniques to manage your risk exposure.

Additionally, consider the impact of transaction costs such as spreads and commissions on your profitability and factor them into your risk management plan.

5. Backtesting Your Strategy is Necessary In Terms of Personal Satisfaction:

Before trading live, it is crucial to backtest your scalping strategy against historical data to evaluate its performance. Use backtesting software or tools like Adaptrade to simulate your strategy over past market conditions and assess its effectiveness.

6. Ultimately, Monitoring And Refinement is All You Must Need:

Once you start trading live, continuously monitor the performance of your scalping strategy and make refinements as needed.

Keep track of your trades, analyze the results, and identify any patterns or trends that may indicate areas for improvement.

Adjust your strategy accordingly, whether it’s fine-tuning indicator parameters, modifying entry and exit rules, or implementing new risk management techniques.

Frequently Asked Questions:

1. Can beginners use Adaptrad to build a scalping strategy?

Absolutely! Adaptrad provides user-friendly tools and resources that cater to traders of all experience levels, making it accessible for beginners looking to dive into scalping.

2. How does Adaptrad assist in optimizing indicator parameters for scalping?

Adaptrad allows traders to experiment with different combinations of indicator parameters and optimize them using advanced optimization algorithms, helping to identify the most effective settings for their scalping strategy.

3. Are there tutorials or guides available for using Adaptrad to build a scalping strategy?

Yes, Adaptrad provides comprehensive tutorials, guides, and support resources to help traders navigate the process of building and optimizing a scalping strategy using their platform.

Conclusion:

Creating a scalping strategy with Adaptrade entails choosing appropriate indicators, refining parameters, and establishing precise entry and exit criteria for swift trading actions in the market.

Also Read: